MSP Business Builders – Revenue Growth Strategies for Managed Service Providers

Industry insights and product roadmaps to enable MSPs to bring innovative new solutions to market.

As the name suggests the MSP Business Builders program is intended as a holistic support service for Managed Service Providers.

As the name suggests the MSP Business Builders program is intended as a holistic support service for Managed Service Providers.

This will include product research to identify high growth market opportunities, with business planning templates, peer learning and networking webinars, and an e-learning marketplace to provide an end-to-end pathway to adopt and sell these new partner solutions.

Market Opportunity

The goal is to provide MSPs with the market insights and channel resources that enables them to expand into new, high-growth product markets.

The potential is huge. Gartner forecasts global spending on public cloud services will grow to over $670 billion in 2024, highlighting how the drive to shift to Cloud services is relentless and ever-expanding, and this will drive demand for a wide spectrum of partner services, from consulting through migration and value add managed services.

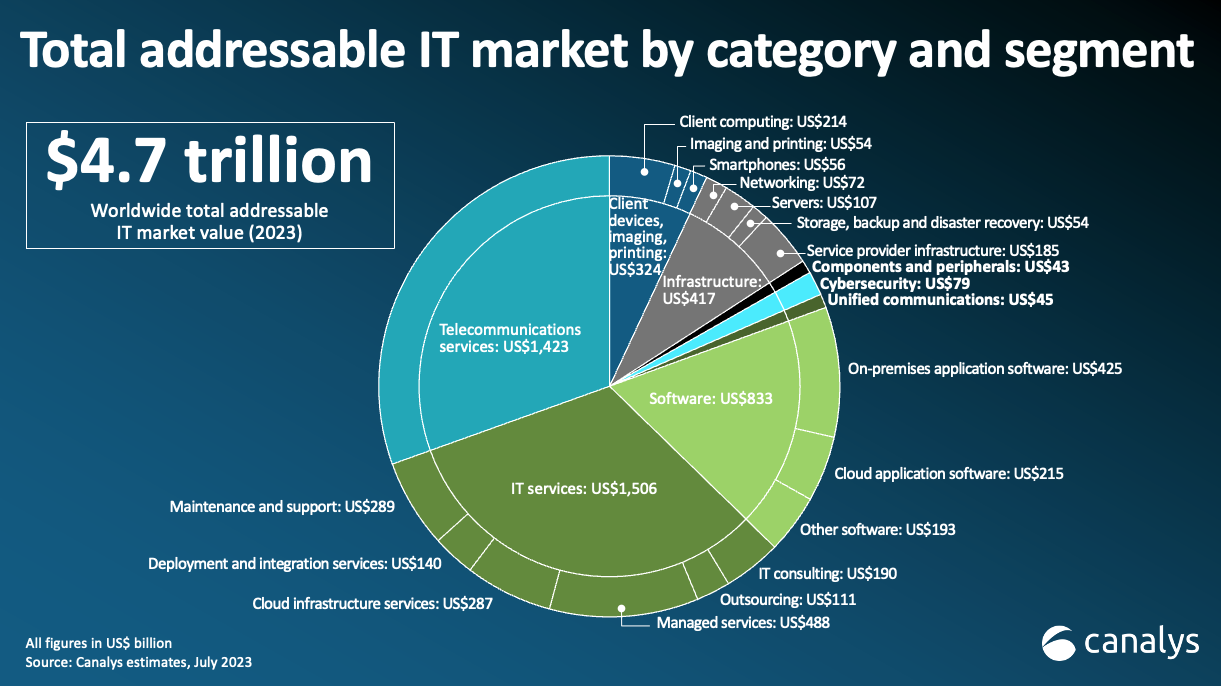

As renowned industry analyst Jay McBain writes on Linkedin the Total Addressable market for MSP services worldwide is an enormous $4.7 trillion, with the major categories being Telco Services, IT Services, Software and Managed Services of different types.

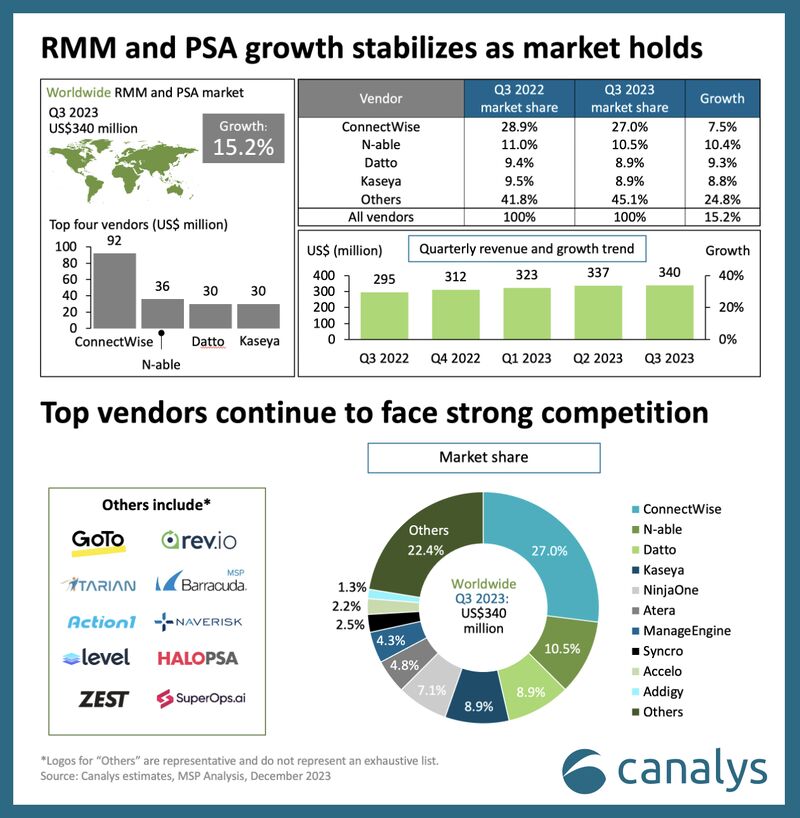

In another post he then zooms in on the $488b MSP industry, highlighting the key role vendors play in enabling MSPs to address this market, specifically Professional Services Automation (PSA) and Remote Monitoring & Management (RMM), led by ConnectWise, Kaseya/Datto and N-able.

Jay describes the dynamics shaping this sector:

“Looking into 2024 and beyond, partners are looking for more native and embedded AI features, particularly for ticket resolution and reporting, scripting, cybersecurity tools, and project management. On the remote management side, the industry is driving towards consolidated endpoint, cloud, and network management tools, with further consolidation in the vendor space likely.”

Cybersec MSP

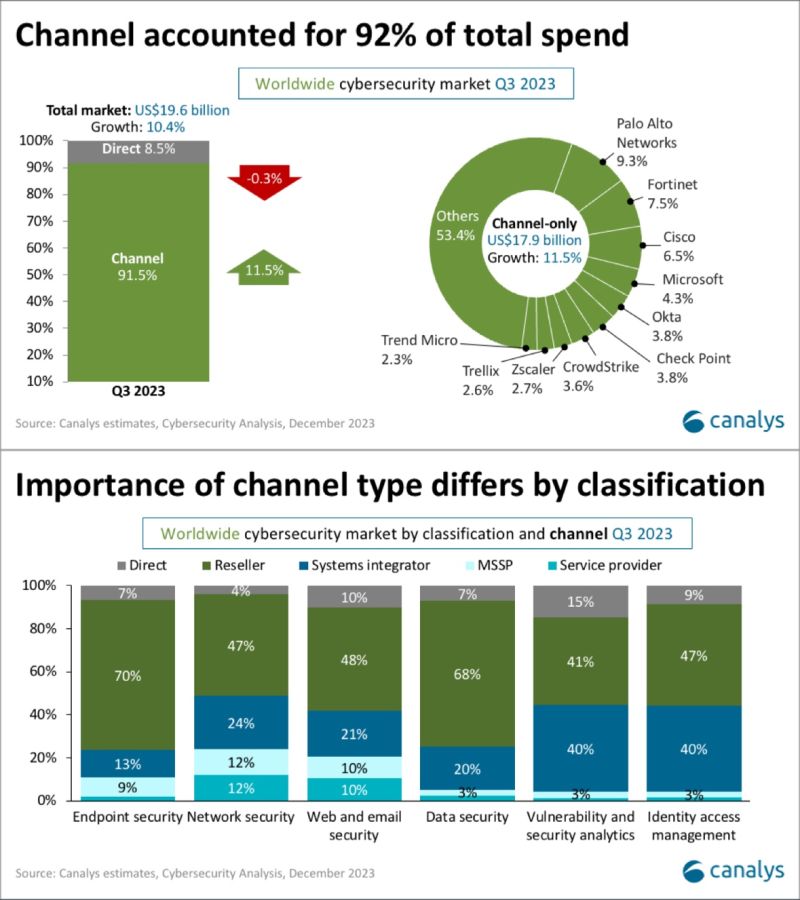

As well as general IT services a key facet of the MSP opportunity is to specialize in other specific, very important segments, such as Cybersecurity.

Again Canalys identifies this market sector and explores the opportunity for channel partners: “Channel sales of cybersecurity grew double digits while direct sales declined last quarter – $18 billion of business flowed through partners. The cybersecurity market was worth $19.6 billion overall, and 91.5% of that was sold via the channel.”

Cutting Edge Innovations

This brief overview captures the essence of the opportunity for MSPs, both in terms of the overall market size and also the niche specialisms within it. Exploring these segments in detail and how to address them profitably is the core purpose of the MSP Builders program.

Furthermore what the analysis doesn’t cover is another critical dimension. Understandable analysts deal with quantifying well established buyer patterns, and tapping into this demand is key to growing sales, but equally another important dynamic is being first to market with new innovations.

For example technologies like Blockchain and Digital Identity aren’t specifically mapped out, don’t feature heavily in the MSP landscape today and are frequently dealt with directly by the vendors providing the technologies, often only to developers.

So another powerful foundation of the program will be a unique specialism in helping MSPs engage with these vendors and build innovative new MSP services based on their capabilities, making possible market first solutions.